Introduction

Stable value is a unique investment product, which can only be offered in tax qualified, defined contribution plans, such as 401(k) 401(a), 403(b) and 457 plans, and some 529 education savings plans and healthcare savings plans. Plan sponsors typically find the low correlation to other asset classes attractive, while providing a distinctive combination of benefits for plan participants:

1. Principal preservation

2. Consistent, positive returns generally higher than money market funds

3. Liquidity for participant benefit payments1

The ability for stable value funds to provide bond-like returns with exceptionally low return volatility provides to investors an attractive risk/return profile. In this paper, we look at ten years of recordkeeping data to identify who is using stable value and the compelling benefits for using stable value.

Who uses stable value?

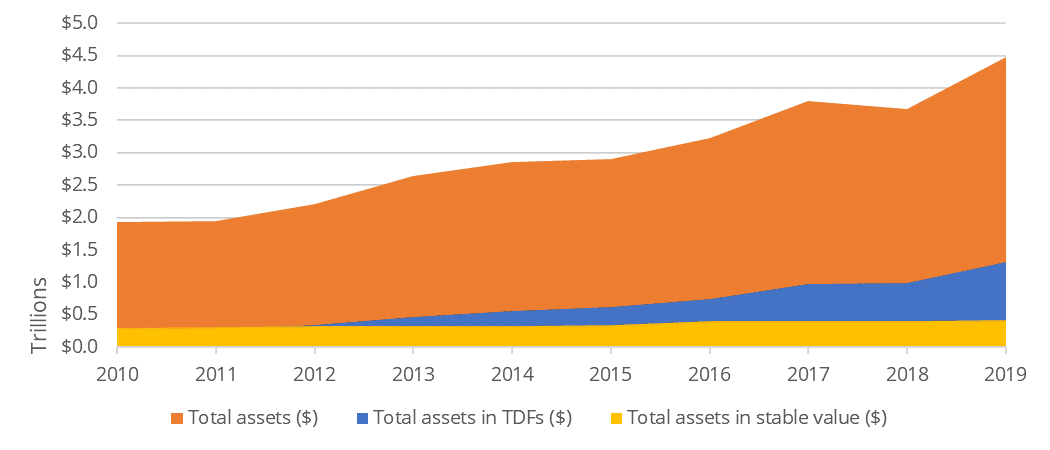

As of year-end 2019, the DC landscape was about $8.2 trillion in assets2. This analysis relies on data from 10 major plan administrators to break down in detail $4.5 trillion in assets from nearly 135,000 plans covering 42 million participants. Within this population, stable value funds were offered to over half of all DC participants as of the end of 2019.

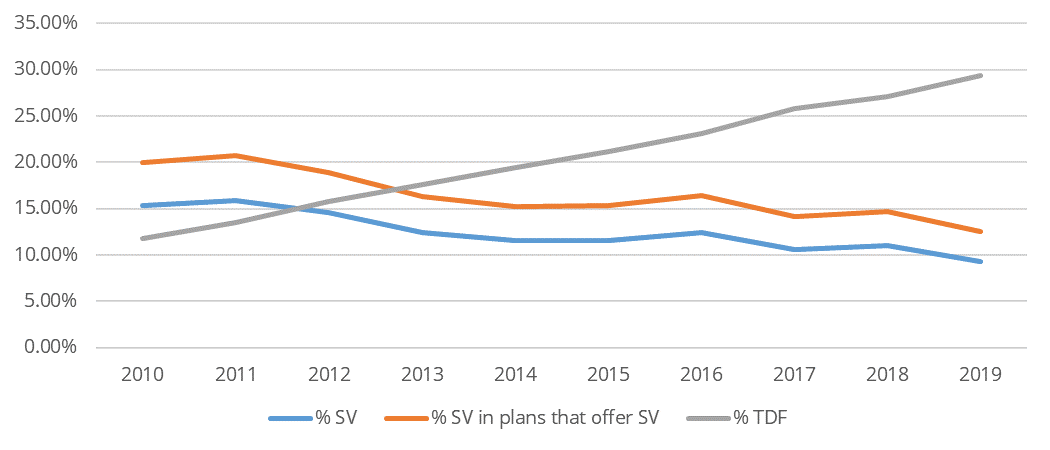

Assets

Over the past decade, participant flows combined with record stock market gains have resulted in stable value assets declining from 15% to 10% of DC assets. Over the same period, these same factors increased target date fund (TDF) assets from 12% to 29%.

DC Assets

Within the universe of plans that offered a stable value option, the data shows a similar decline in plan assets allocated to stable value (from 20% of plan assets in 2010 to 12.5% in 2019).

Asset Summary

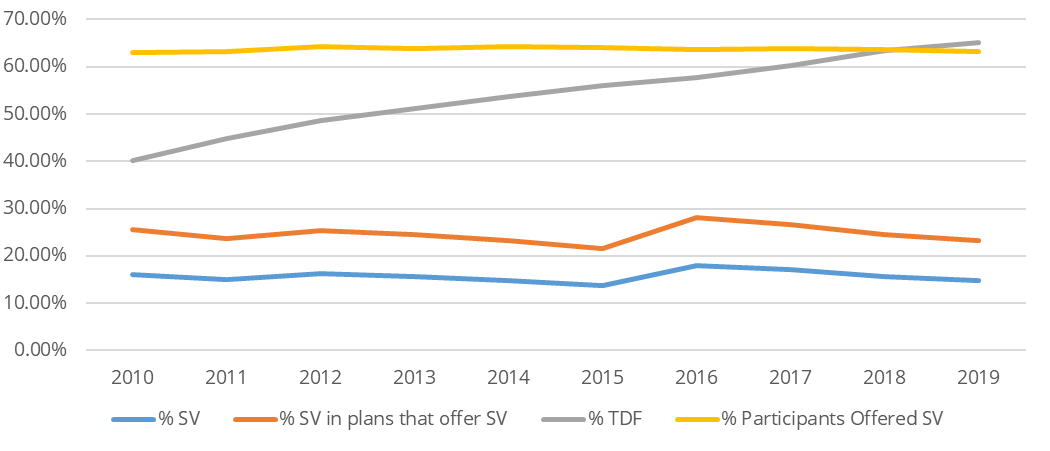

Participants

Within our survey, more than 26.6 million participants were offered a stable value option as of Q4 2019, which comprises 63% of DC participants in the survey. While 63% of all plan participants were offered stable value, only 14-18% of all plan participants allocated some of their retirement assets to stable value in each year surveyed. When considering the population of participants to whom stable value is offered, 22-28% of all participants that had access to a stable value option allocated some of their assets to stable value.

Plan sponsors are required to offer an investment menu that includes diversified funds from a range of asset classes (equity and fixed income) and a low-risk capital preservation option. Many plan sponsors choose stable value funds for the low-risk capital preservation option, and it is more heavily utilized by plan participants nearing or in retirement to achieve their retirement savings and investment objectives.

Participant Summary

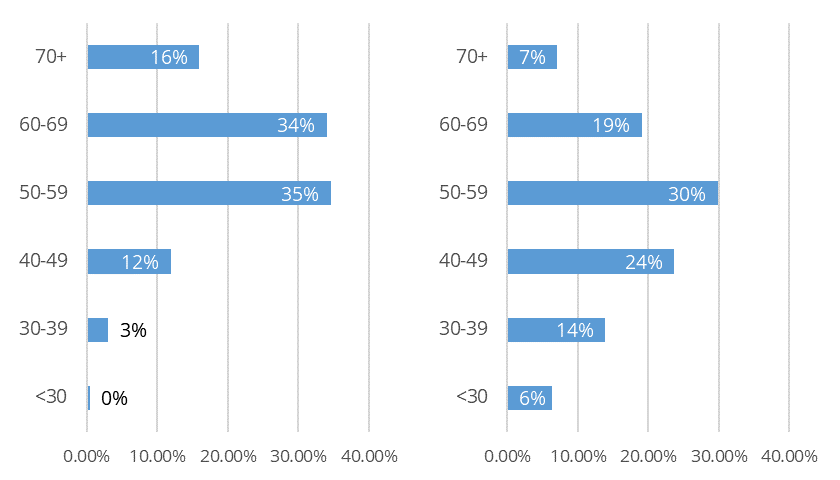

Age Cohorts

We also analyzed the breakdown by age cohorts for both assets and participants. As may be expected, older participants tend to have higher account balances and, therefore, owned a disproportionately higher percentage of assets relative to the participant base. Nearly 85% of stable value assets were held by participants 50 and older, representing 56% of total participants. Conversely, about 20% of participants who invest in stable value are 39 and younger, representing only 3.5% of total assets.

Left – Assets by Age Cohort & Right – Participants by Age Cohort

Why do participants invest in stable value?

Stable value products provide an attractive principal preservation investment, insulating plan participants from day-to-day market volatility while providing them with relatively steady returns and readily available liquidity. To provide these benefits, stable value products may utilize one or more types of stable value investment contracts. These contracts are issued by creditworthy insurance companies or banks and provide a financial commitment to credit to participants a minimum rate of interest (no less than 0%). This allows participants to transact or withdraw at contract value (their deposits plus accrued interest), rather than at the market value of the assets backing the contract.

Let us explore the return and volatility components a bit further.

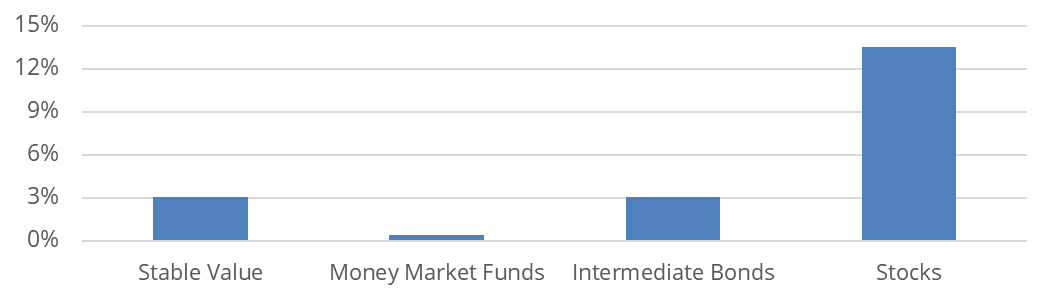

Positive returns combined with capital preservation

Like a bond fund, stable value funds can take advantage of the term premium, credit and convexity risk premiums, and the spread differential over similar duration U.S. Treasury bonds. Unlike bond funds, stable value funds offer day-to-day principal preservation via the contractually set crediting rates provided by the stable value contracts. Through these features, stable value contracts provide day-to-day principal preservation with long-term rates of return that are consistent with those of intermediate-term investment grade bonds. While ill-timed negative returns from stocks and bonds can have significant implications on a retirement account, having stable value in a portfolio can help offset some of those losses and mitigate the downstream impacts for retirement.

Annualized Returns3

January 2010 – December 2019

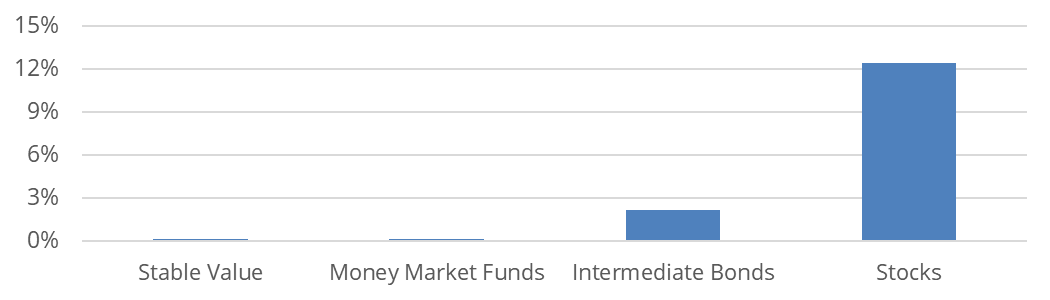

Lower volatility

Stable value funds benefit from unique accounting standards available to defined contribution savings plans that allow contract value accounting for stable value portfolios, rather than the mark-to-market accounting required for most other plan investments. This accounting standard allows stable value products to smooth the returns earned by plan participants and insulate them from daily market volatility. As a result, stable value is less volatile than other asset classes.

Standard Deviation of Monthly Returns4

January 2010 – December 2019

These benefits make stable value ideally suited for plan participants seeking to protect their retirement savings and provide a source of income during retirement. Stable value is also used by plan participants seeking to be more aggressive with their retirement investing since stable value has a low correlation to more volatile, higher returning investments like equities. With increased usage of stable value in customized asset allocation, advice, and retirement income solutions, younger investors are also discovering stable value’s benefits and critical role in their retirement portfolios and 529 education savings plans. It is also important to reiterate that stable value funds are not available outside of tax qualified, defined contribution plans; thus, plan participants who transfer their retirement assets into a rollover IRA lose their access to a stable value solution.

Conclusion

Stable value can be and is used for a variety of reasons in one’s investment portfolio. Recordkeeping data shows that stable value investors are predominantly represented by older plan participants, as those 60 years and older own approximately half of stable value assets and those who are 50 years and older own approximately 85% of stable value assets. This data supports the importance of stable value to those plan participants who are nearing or in retirement. However, as has been illustrated earlier, stable value also has value for younger investors as well.

Stable value is a great “all weather” solution, as it has withstood the test of time through many challenging market cycles over the past 50 years. The consistent, low-volatility contract value returns make stable value a good source of retirement income as well as a safe option to provide downside protection, especially during periods of market volatility.

Endnotes

1 – For more information on how stable value products work, see Stable Value – An Investment Solution Worth Knowing (https://stablevalue.org/stable-value-an-investment-solution-worth-knowing).

2 – Investment Company Institute as of 4Q 2019.

3 – “Stable Value” is a simulation of book value returns in a hypothetical fund holding intermediate bonds and stable value wrap contracts, with crediting interest rates reset monthly using the industry accepted crediting rate formula. The bond returns incorporated into the simulation are monthly market value returns from the Barclays Intermediate Government/Credit Bond Index, with gains/losses reflected in future crediting rates by amortizing market-vs.-book values over intermediate bond index durations. This simulation incorporates no ongoing cash flows into or out of the fund. Returns illustrated are gross before any fees. “Money Market Funds” is a simulation of money market returns from the iMoneyNet MFR Money Funds Index. Returns illustrated are gross before any fees. ”Intermediate Bonds” is a simulation of market value bond fund returns from the Barclays Intermediate Government/Credit Bond Index. Returns illustrated are gross before any fees. “Stocks” is the S&P 500 Index with dividends reinvested: a widely used barometer of U.S. stock market performance; as a market-weighted index of leading companies in leading industries, it is dominated by large-capitalization companies. Returns illustrated are gross before any fees. Disclaimer: The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data cited. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

4 – Ibid.